nebraska vehicle tax calculator

Your average tax rate is. For example lets say that you want to purchase a new car for 60000 you would use the following formula to calculate the sales tax.

It Is Said That Everyone Can Get A Bad Credit Loan However This Is Not Always True There Are Some People That Can Neve Payday Loans Personal Loans Cash Loans

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

. In Nebraskas largest counties however rates can occasionally exceed 2. Our required dealer documentation fee is 299. You can find these fees further down on the page.

Nebraska Online Vehicle Tax Estimator Gives Citizens Tax. The nebraska state sales and use tax rate is 55. The average effective property tax rate in Nebraska is 161 which ranks among the 10 most burdensome states in the country when it comes to real estate taxes.

The state of NE like most other states has a sales tax on car purchases. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. The estimated tax and registration combined is 3624 but this may vary based on your location.

Money from this sales tax goes towards a whole host of state-funded projects and programs. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Omaha Ne Sales Tax Calculator.

USA Tax Calculator 2021. You may also be interested in printing a Nebraska sales tax table for easy calculation of sales taxes when you cant access this calculator. Vehicles are considered by the IRS as a good that can be purchased sold and traded.

50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. NEW - Appointments are now available for ALL driver licensing services permits licenses and State ID Cards at the 17007 Burt Street Service Center in Omaha. Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers.

If you are registering a motorboat contact the Nebraska Game and Parks Commission. Buying a vehicle is. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services.

The cost of a car title in NE is 10. Click here to make an appointment for any driver licensing service including Class O car drive tests. The value of the property is assessed by an appraisal of the true market value of the property.

Here are five additional taxes and fees that go along with a vehicle purchase. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to factor in state taxes titling and registration fees vehicle inspectionsmog test costs and car insurance into your total cost. Consumer Notes The documentation fee is set by the dealer but is.

For vehicles that are being rented or leased see see taxation of leases and rentals. This means that your sales tax is 3300 on a 60000 purchase price. Simply enter the costprice and the sales tax percentage and the NE sales tax calculator will calculate the tax and the final price.

Class O Car drive tests in Lincoln and Bellevue require an appointment. 550 Nebraska State Sales Tax -350 Maximum Local Sales Tax 200 Maximum Possible Sales Tax 680 Average Local State Sales Tax. With a sales tax rate of 55 in Nebraska this means you are paying an additional amount equal to 55 of the vehicles value at the point of sale.

Nebraska Income Tax Calculator 2021 If you make 70000 a year living in the region of Nebraska USA you will be taxed 11756. You can find more tax rates and. Adjust quote numbers in calculator.

Nebraska Sales Tax on Cars. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning jan. Nebraska has a 55 statewide sales tax rate but also has 295.

You can use our Nebraska sales tax calculator to determine the applicable sales tax for any location in Nebraska by entering the zip code in which the purchase takes place. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. 60000 x055 3300. Farmers and ranchers pay 29 and commerce and industry pay 17.

The Nebraska sales tax on cars is 5. 150 - State Recreation Road Fund - this fee. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055.

You must have the vehicles VIN vehicle identification number in order to get an estimate. Additional fees collected and their distribution for every motor vehicle registration issued are. Online Estimate You can obtain an online vehicle quote using the Nebraska DMV website.

200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. If you live in the city limits of Bellevue Papillion La Vista Gretna or Springfield you need to select your city to get the correct sales tax computation.

Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Nebraska QuickFacts. This is less than 1 of the value of the motor vehicle. Nebraska Online Vehicle Tax Estimator Gives Citizens Tax and Fee Estimates Nebraska public-private collaboration helps consumers estimate costs before automobile purchases.

4200-pound vehicle weight 100 x 2 84. Nebraska vehicle tax calculator. You are able to use our Nebraska State Tax Calculator to calculate.

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Car Depreciation How Much It Costs You Carfax

Is Car Insurance Tax Deductible H R Block

What Is The Average Company Car Allowance For Sales Reps

Dmv Fees By State Usa Manual Car Registration Calculator

Sharp 12 Digit Calculator White Calculadora Controle De Acesso Relogio De Ponto

Car Tax By State Usa Manual Car Sales Tax Calculator

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Car Financing Are Taxes And Fees Included Autotrader

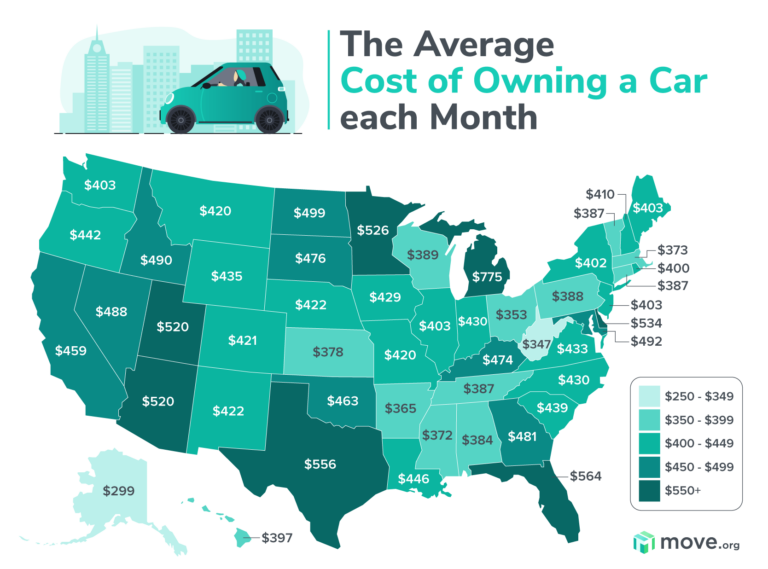

The Average Cost Of Owning A Car In The Us Move Org

Which U S States Charge Property Taxes For Cars Mansion Global

Vehicle And Boat Registration Renewal Nebraska Dmv

Auto Loan Calculator Estimate Monthly Car Payments Online For Free

Vehicle And Boat Registration Renewal Nebraska Dmv

Dmv Fees By State Usa Manual Car Registration Calculator

How To Calculate Your Car Detailing Business Income Potential

Dmv Fees By State Usa Manual Car Registration Calculator

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price